Mortgage points break even

So if points cost you 2000 and saved 40 per month then it would take 50 months to break even 200040 50. Cost of Points - The calculator assumes that 1 mortgage point costs 1 of the mortgage amount.

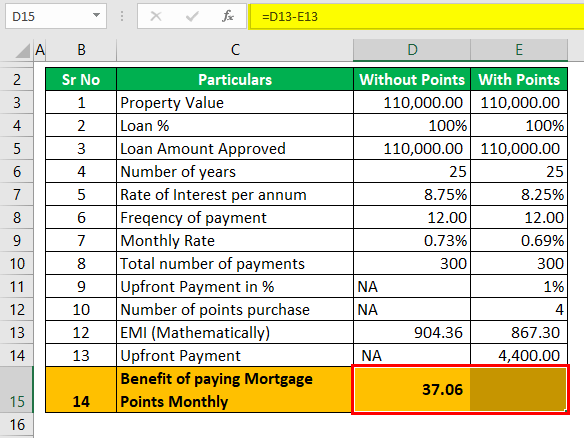

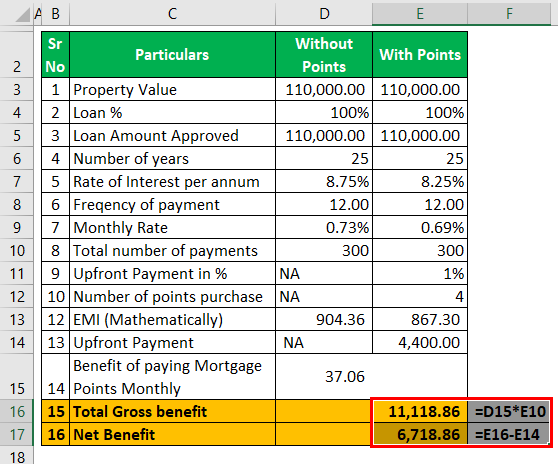

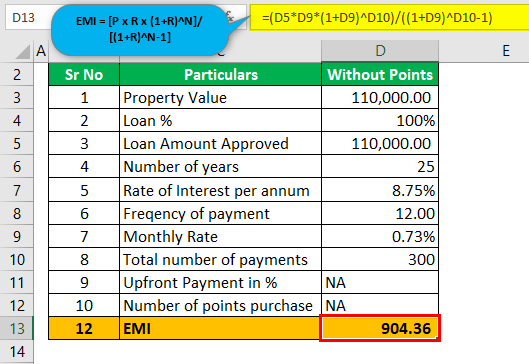

Mortgage Points Calculator Calculate Emi With Without Points

Up to 25 cash back How Much Do Mortgage Discount Points Cost.

. Break-Even Period - The break-even period is the time it will take for the savings provided by the mortgage points to surpass the initial cost of the points. Ad What is an Adjustable Rate Mortage. After you break even youll start saving money.

4000 Your up-front mortgage points cost 5854 Your monthly payment savings 68 Number of months to reach your break-even point Payments beyond your break-even point are where you really start saving. The discount points break even calculator will calculate how much money you will save with mortgage points and when is the break even point. As mentioned earlier the cost of 175 points on a mortgage with a 200000 loan amount is 3500.

Heres how to calculate your break-even point. This is calculated by dividing the cost of points by the monthly savings generated. To determine the break-even point you divide your closing costs by the amount you save every month.

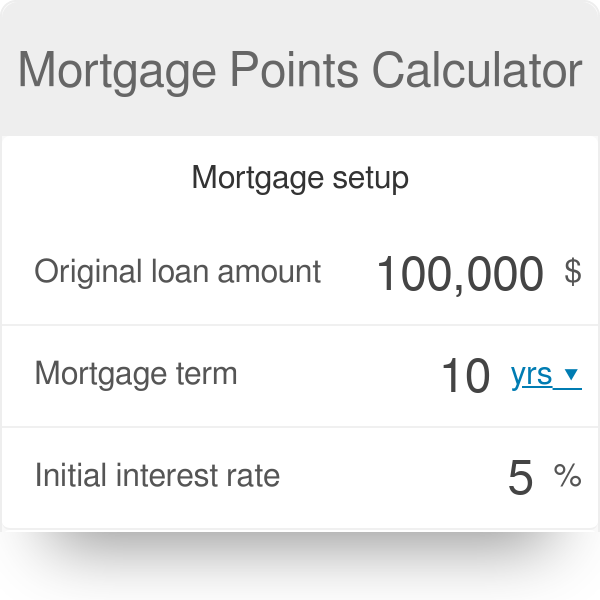

This calculator shows the costs and benefits of paying points to reduce the rate on an FRM and the minimum period they must hold an FRM before it makes sense to pay additional points the break-even period. That depends on a multitude of factors including your current interest rate the new potential rate closing costs and how long you. Fill out your loan terms before paying mortgage loan points First youll need to put your original loan terms into the mortgage points calculator under the column marked Less points These are the.

So you might have to pay four points to reduce your rate by a full percent. But if you buy two points by paying 4000 and your rate goes down to 45 the monthly payment falls to 101337. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

The result is the amount of time it would take you to breakeven on the deal. Dividing 3000 by 33 you get 91 months you have to wait to break evenMost people see the light and opt out of doing it Sometimes the light can blind. Say you buy one point on a mortgage loan of 300000 which costs 3000 1 of the loan amount.

They sort of cancel each other out. DO NOT USE DOLLAR SIGNS COMMAS PLUS SIGNS OR PERCENTAGE SIGNS IN ANY INPUT BOXES. As an example lets say you save 50 per month by refinancing but the loan comes with 5000 in closing costs.

How Does it Work. Ad You Could Lower Your Monthly Payment When You Refinance With Chase. Because of this refinances grew drastically in 2020 even outpacing home purchases at certain points in the year.

Review your mortgage points calculator results 1. Over 15 million customers served since 2005. A Rating with BBB.

Alright its time to go back to math class again. The simple calculation for breaking even on points is to take the cost of the points divided by the difference between monthly payments. The table below illustrates the monthly savings from paying one or two discount points on a 200000 mortgage with a base interest rate of 5 and a 30-year term.

If you divide the upfront cost of the points by your monthly savings youll find that your breakeven point is about 76 months 350046 equals 7601 which is equal to roughly 6 years and 3 months. Mortgage Points Calculator to calculate how long it takes to break even with discount points for your mortgage. The break-even point is when the interest you saved is equal to the amount you paid for mortgage points.

Mortgage Points Break-Even Using the example above lets say you get a 30-year loan of 200000 with a 5 fixed interest rate. Ad Our technology will match you with the best home loan refinance lenders at super low rates. Your lender can help you decide whether paying points is right for you.

What are the Pros and Cons. Typically one point is equal to 1 of the loans principal and it usually buys the rate down by 025. Compare Refi Lenders for 2022.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Mortgage rates have been significantly falling since 2019 decreasing even further when the COVID-19 crisis hit the US. Prequalify For A Lower Interest Home Loan.

Lets calculate the break-even point from our example we used before. What Is the Break-Even Point on a Mortgage. Close to 2 million home loans were refinanced between January through April.

Ad Get Mortgage Refinance Rates Rates Are Still Low Top 5 Mortgage Refi Lenders for 2022. How long will it take to break even on a mortgage refinance. Your monthly payment will be 107364.

On a 200000 loan a 14 lower rate reduces the monthly payment by about 33 a month whereas 15 points amounts to 3000. Without discount points the. How Much Money Can You Save By Refinancing Your Home Loan.

To do this just divide the cost of. What This Calculator Does.

Calculate Mortgage Discount Points Breakeven Date Should I Pay Points On My Home Loan

Mortgage Discount Points Calculator Mortgage Calculator

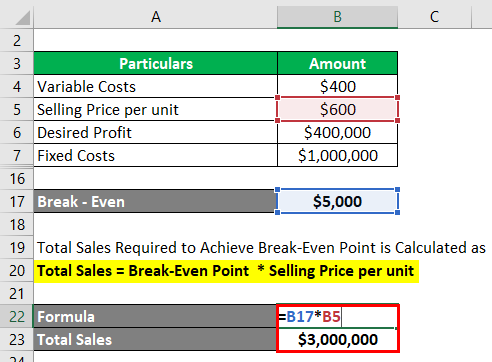

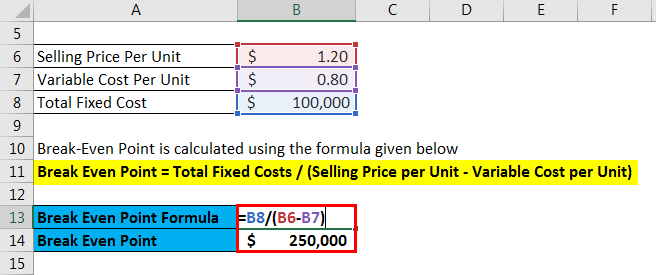

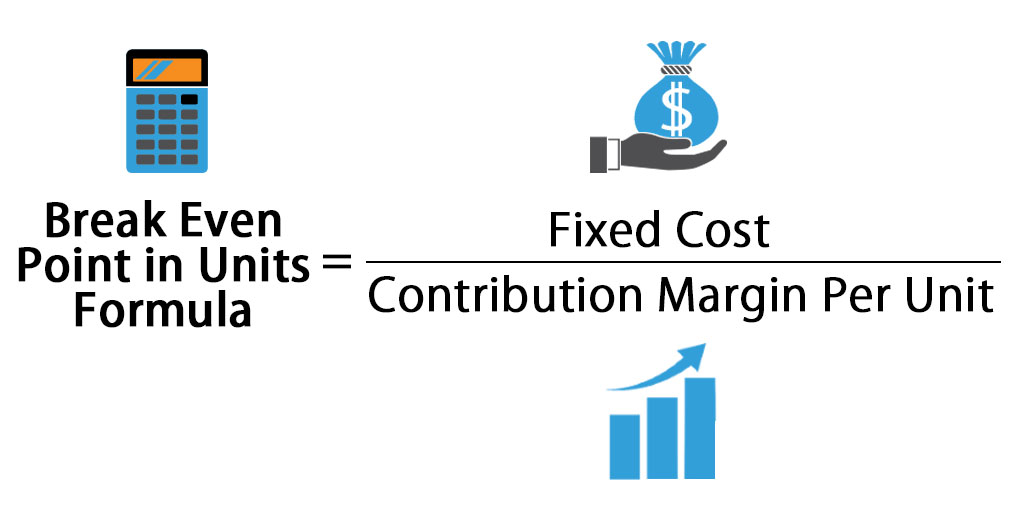

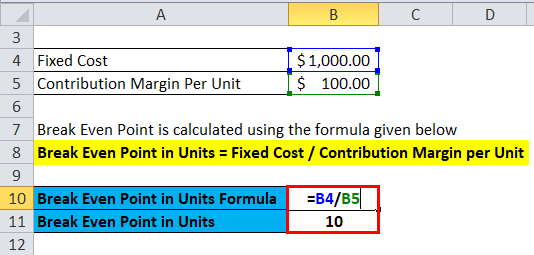

Break Even Analysis Example Top 4 Examples Of Break Even Analysis

Mortgage Points Calculator 2022 Complete Guide Casaplorer

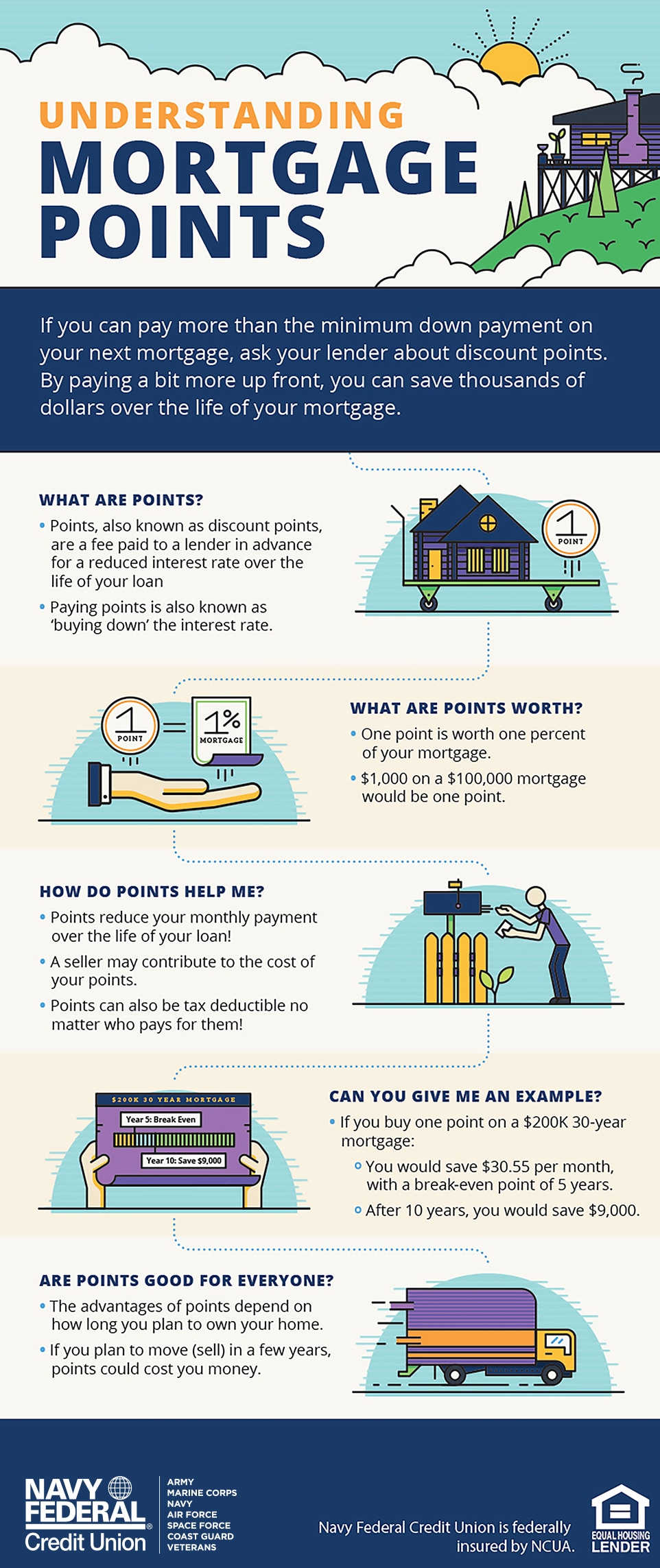

What Are Mortgage Points

Break Even Analysis Formula Calculator Excel Template

Mortgage Points A Complete Guide Rocket Mortgage

Mortgage Points Calculator Calculate Emi With Without Points

How Do Mortgage Points Work Navy Federal Credit Union

Mortgage Points A Complete Guide Rocket Mortgage

Mortgage Discount Points Calculator Mortgage Calculator

Mortgage Points Calculator Calculate Emi With Without Points

![]()

Discount Points Break Even Calculator Home Mortgage Discount Points Explained

Break Even Analysis Formula Calculator Excel Template

Break Even Analysis Formula Calculator Excel Template

Break Even Analysis Formula Calculator Excel Template

Mortgage Points Calculator